Is big data enough? Aggregate numbers can tell you a lot, but they say very little about how individual customers are thinking and talking about your products.

In the article, Don’t Let Data Paralysis Stand Between You and Your Customers, From Data to Action: a Harvard Business Review Insight Center Report, Harald Fanderl shares that:

“Back when there were a handful of channels, interactions between customers and brands were relatively simple. Today, by contrast, more than half of all customers move through three or more channels to complete a single task.”

To open a bank account today, for instance, a typical customer embarks on a multichannel journey: researching online, downloading an application, speaking to a call center agent, linking brokerage accounts, visiting a branch, and installing the bank’s mobile app.

Those steps leave a long and complex digital trail. That multichannel complexity, combined with the scale of the data makes divining insights into customer behaviors a serious challenge.

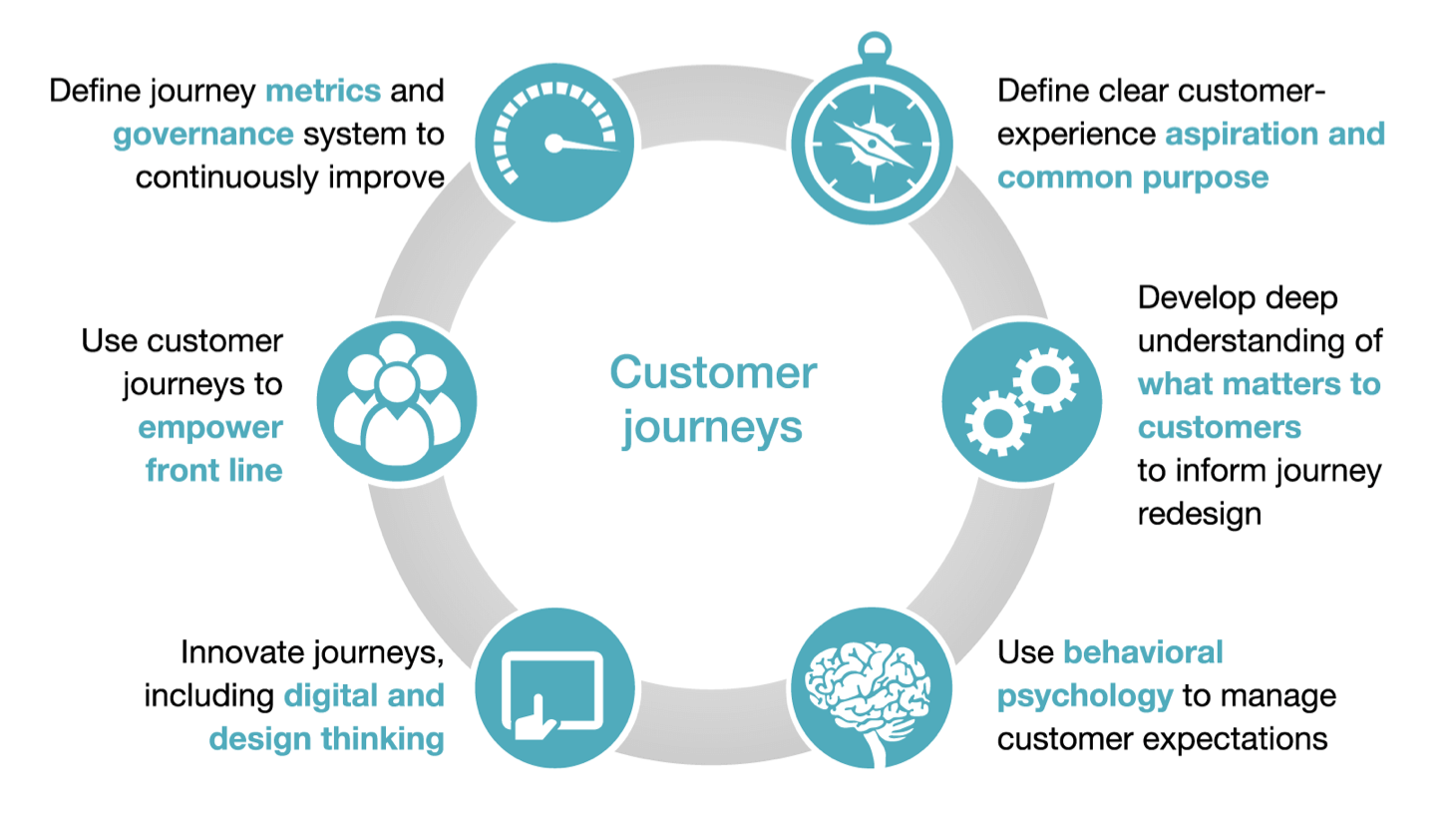

Parsing this data, however, is critical to improving the customer experience and growing your business. The most productive way to get there is not by fixing individual touchpoints but by improving the entire customer journey—the series of customer interactions with a brand needed to accomplish a task.

McKinsey analysis finds that companies acting on journey insights have seen a 15-20% reduction in repeat service visits, a 10-20% boost in cross-selling, and a drop of 10-25 basis points in churn.

Companies may feel they need to study all the bits and bytes available to them. But research shows that three to five journeys matter most to customers and the bottom line. They generally include: some combination of sales and on-boarding; one or two key servicing issues; (1) moving and account renewal, and (2) fraud, billing, and payments. Narrowing the focus to those journeys allows companies to cut through the data clutter and prioritize.

For instance, a cable television player used advanced data analysis of multichannel customer behaviors to focus on where drop-offs in the journey occurred in two journeys—on-boarding and problem resolution—to address nagging customer retention and loyalty issues. The data team helped them identify key service troubles spots and ways to improve the on-boarding process. Those insights led to several policy changes, including creating a “learning lab” that effectively operated as a mini-company to trial and refine new approaches. The changes improved customer satisfaction scores by more than 20%.

Fanderl also shares that you shouldn’t wait for the data to be perfect. Companies often hesitate to take action for fear their data is missing or a mess. Successful organizations tend not to overthink all the details and instead just roll up sleeves and get to work. Most companies, in fact, already have the data they need. The challenge is pulling the data together. Companies need to figure out where that data is stored, and what it takes to extract and aggregate it so they can understand the customer journey across multiple touch points. Since data often lives in systems managed by various functions, bring the necessary operations, IT, in-store sales, and marketing people together to identify the touchpoints.

Fanderl also shares that you should focus on the analytics – not reporting. Companies tend to focus on generating reports from their data about what has happened. Much greater value, however, comes from analyzing data to pinpoint cause and effect and make predictions. Analyzing patterns allows you to develop an early warning system that fagged high-risk customers.

Big data harbors big opportunities to improve customer journeys and value. What it requires is a commitment to focus on what really matters.